CYPRUS

PERMANENT RESIDENCY

PROGRAM

PERMANENT RESIDENCY

PROGRAM

CYPRUS OVERVIEW

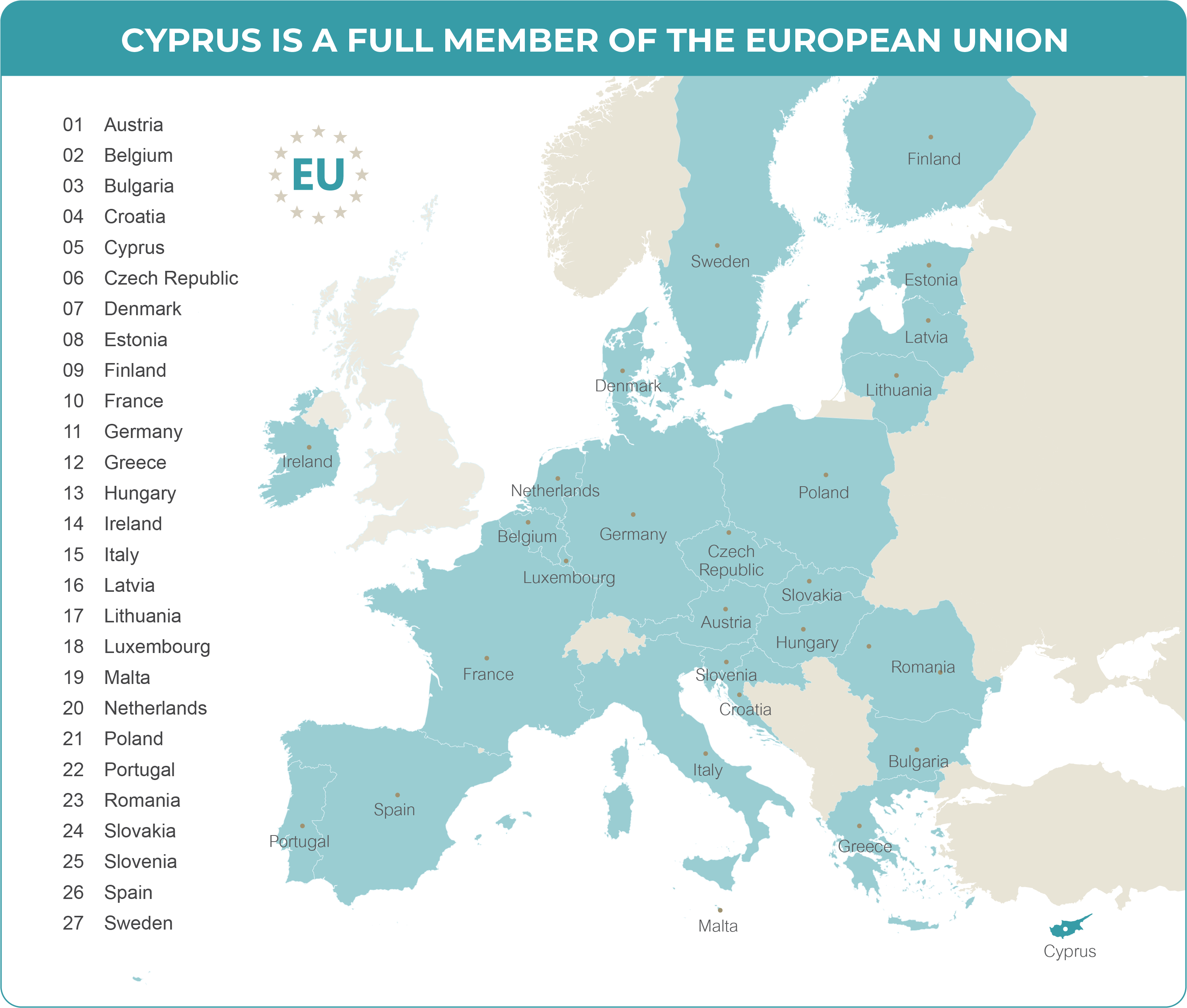

Cyprus is a member state of the European Union since 2004 and

has a strong legal and tax system, as well as more than 30 years of

experience as an international business centre, with highly qualified

professionals and sophisticated infrastructure. It is a country

with a strategic location, long history and culture, as well as nice

weather with almost year-round sunshine.

- GOVERNMENT Presidential Republic

- POPULATION 447 Million

- AREA 4,233,255.3 km2

- FOUNDED 1993

- CLIMATE Mediterranean temperature 23°c

- CURRENCY Euro

- MEMBERSHIP EU & Eurozone / 27 member state

- OFFICIAL LANGUAGE English

CYPRUS OFFERS THE MOST FAVOURABLE TAX INCENTIVES IN EUROPE

Tax planning advantages in Cyprus reach far beyond saving tax (money). It is a complete business strategy for investment, as well as a global solution for financial efficiency.

These benefit are for large corporate companies, small and dedium size enterprise, as well as individuals.

MAIN FEATURES

- Taxation is based on Residency status

- Notional Interest Deduction on new equity invested

- Fully reformed Intellectual Property Regime

- Capital gains on sale of securities: 100% exemption

- Capital gains from the sale of immovable property situated outside Cyprus are tax exempt

- Applicability of all EU directives

- Advanced ruling practice exists

- Extensive and expanding favourable Double Tax Treaty network (with 61 countries)

MAIN FEATURES

Classification of Non-domiciled resident

- an individual who has obtained and maintained a domicile of choice outside Cyprus under the provisions of the Wills and Succession Law, provided that this individual was not a Cyprus tax resident for a period of at least 20 consecutive years prior to the tax year in question; or

- an individual who was not a Cyprus tax resident for a period of at least 20 consecutive years immediately prior to the entry into force of the introduced provisions

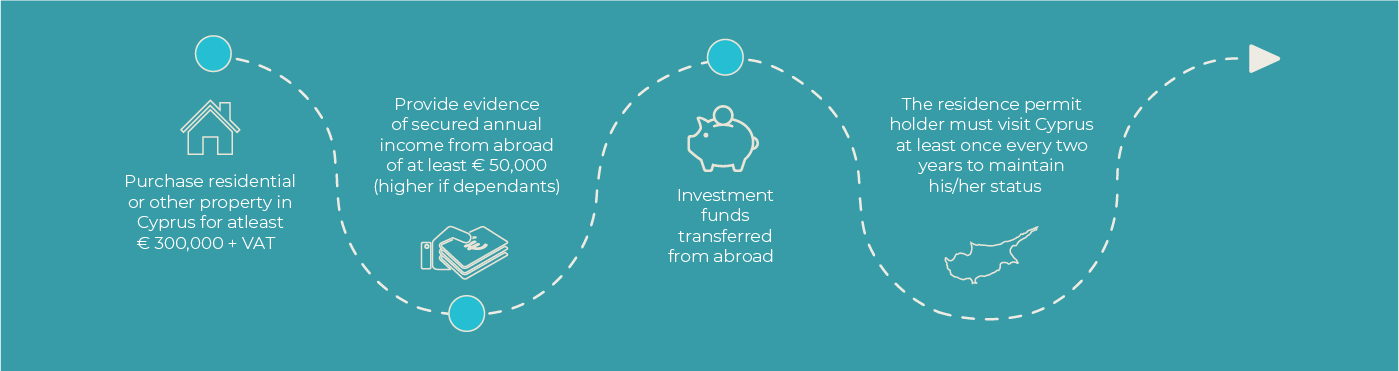

THE FAST - TRACK PERMANENT RESIDENCE PROGRAM

enables the granting of a permanent residence permit to foreigners who intent to invest in Cyprus, provided that the following requirement as met :

- FSTEP 1: SELECT REAL ESTATE INVESTMENT Investor selects property/ies either by visiting Cyprus or through correspondence

- STEP 2: PAYMENT Purchase Agreement signed Minimum requirement of € 300,000 + VAT as initial payment Permanent Residency fee € 500 per application

- STEP 3: DOCUMENTATION SUBMISSION Required residency documents need to be prepared and submitted to the Civil Registry & Migration Department, or to the District offices

- STEP 4: ISSUE OF PERMANENT RESIDENCY Residency Permit is issued within 2-4 months

- STEP 5: RESIDENCY PERMIT AND ID CARDS Upon approval, the applicant is required to visit Cyprus within one year to obtain the actual permit and digital ID cards

- STEP 6: VISIT CYPRUS EVERY 2 YEARS The applicant and any dependants included in the PR must visit Cyprus at least once every two (2) years